White Rock, British Columbia, March 05, 2024 – Honey Badger Silver Inc. (TSXV: TUF) (“Honey Badger” or the “Company“), announces the acquisition of additional claims adjacent to its wholly owned Plata Project in the Yukon Territory. Recent compilation work on the Company’s Plata Project has confirmed similarities to the adjacent exciting Rogue Project owned by Snowline Gold (TSXV: SGD). Rogue appears to be one of the most exciting and potentially one of the largest recent mineral discoveries anywhere in the world.

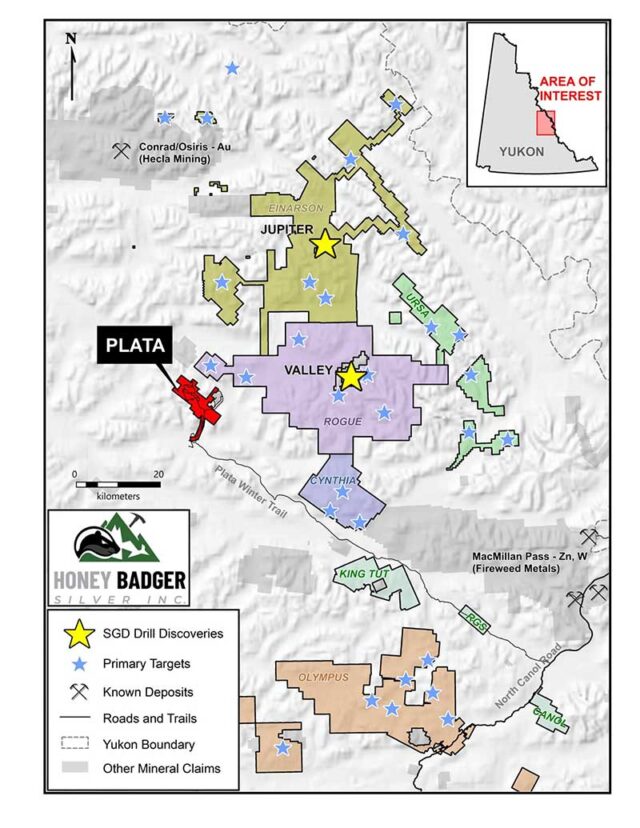

Honey Badger’s CEO, Dorian L. (Dusty) Nicol, commented, “Plata hosts spectacular high grade silver mineralization, traditionally interpreted as a Keno Hill analogue. Recent mapping and compilation work confirm the similarity of Plata geology to the geologic setting at Snowline Gold’s adjacent Rogue Project where, about 30km east of Plata at the Valley discovery, recent drilling has intersected exceptional gold intercepts such as 2.48 gpt Au over 553.8 meters. G eologic mapping during the last field season led to our current interpretation of Plata as being related to the same style of mineralization (“Reduced Intrusion Related Gold System” or RIRGS) as at Valley. Our observations at Plata fit into a mineralization zoning model indicating that surface vein mineralization at Plata is the periphery of a RIRGS mineralizing system. This significantly expands the discovery potential at Plata. Our new claims cover a geophysical magnetic low which we interpret as representing a possible buried intrusion that fed the mineralizing system.”

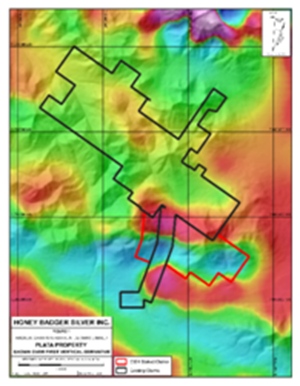

The new claims are adjacent to the Plata Project, comprise 69 individual claims covering 1,430 hectares, and cover the heart of the geophysical magnetic low (See Figure 1).

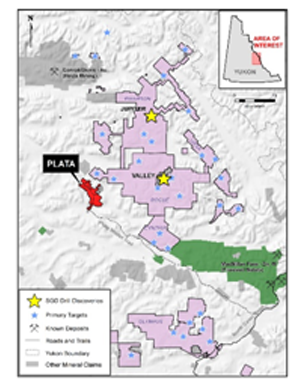

Figure 2 shows the location of the Plata claims in relation to Snowline’s Rogue Project.

The claims were staked by ECEE Money Ltd. (“ECEE”), a private corporation controlled by W. Douglas Eaton, a former director of Honey Badger, with the concurrence and knowledge of Honey Badger. ECEE has transferred ownership of the claims to Honey Badger at no cost, subject to a 2% net smelter royalty (“NSR”) on future commercial gold production. The NSR applies only to gold.

Qualified Person

Technical information in this news release has been approved by Dorian L. (Dusty) Nicol, the Company’s CEO (PG, FAusIMM), who is a Qualified Person (“QP”) for the purpose of National Instrument 43-101.

About Honey Badger Silver Inc.

Honey Badger Silver is a silver company. The company is led by a highly experienced leadership team with a track record of value creation backed by a skilled technical team. Our projects are located in areas with a long history of mining, including the Sunrise Lake project with a historic resource of 12.8 Moz of silver Indicated and 13.9 Moz of silver Inferred (1)(3) located in the Northwest Territories and the Plata high grade silver project located 165 km east of Yukon’s prolific Keno Hill and adjacent to Snowline Gold’s Rogue discovery. The Company’s Clear Lake Project in the Yukon Territory has a historic resource of 5.5 Moz of silver and 1.3 billion pounds of zinc (2)(3). The Company also has a significant land holding at the Nanisivik Mine Area located in Nunavut, Canada that produced over 20 Moz of silver between 1976 and 2002. (2,3)

- Sunrise Lake 2003 RPA historic resource: Indicated 1.522 million tonnes grading 262 grams/tonne silver, 6.0% zinc, 2.4% lead, 0.08% copper, and 0.67 grams/tonne gold and Inferred 2.555 million tonnes grading 169 grams/tonne silver, 4.4% zinc, 1.9% lead, 0.07% copper, and 0.51 grams/tonne gold.

- Clear Lake 2010 SRK historic Resource: Inferred 7.76 million tonnes grading 22 grams/tonne silver, 7.6% zinc, and 1.08% lead.

- Geological Survey of Canada, 2002-C22, “Structural and Stratigraphic Controls on Zn-Pb-Ag Mineralization at the Nanisivik Mississippi Valley type Deposit, Northern Baffin Island, Nunavut; by Patterson and Powis.”

- A qualified person has not done sufficient work to classify this historic tonnage estimate as a current mineral resource and the Company is not treating the estimate as a current mineral resource. The historic tonnage estimate cannot be relied upon. Additional work, including verification drilling / sampling, will be required to verify the estimate as a current mineral resource.

ON BEHALF OF THE BOARD

Dorian L. (Dusty) Nicol, CEO

For more information please visit our website www.honeybadgersilver.com or contact Ms. Michelle Savella for Investor Relations | [email protected] | +1 (604) 828-5886.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Honey Badger to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Such factors include, but are not limited to, risks relating to capital and operating costs varying significantly from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR+ (www.sedarplus.ca) under Honey Badger’s issuer profile. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed timeframes or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

& Associates (1981) Limited, and Qualified Person (QP) for the purpose of National Instrument 43-101.

& Associates (1981) Limited, and Qualified Person (QP) for the purpose of National Instrument 43-101.