Honey Badger Silver Signs Definitive Agreement for Additional Thunder Bay Silver Properties Confirms Dominant Position in the Thunder Bay Silver District

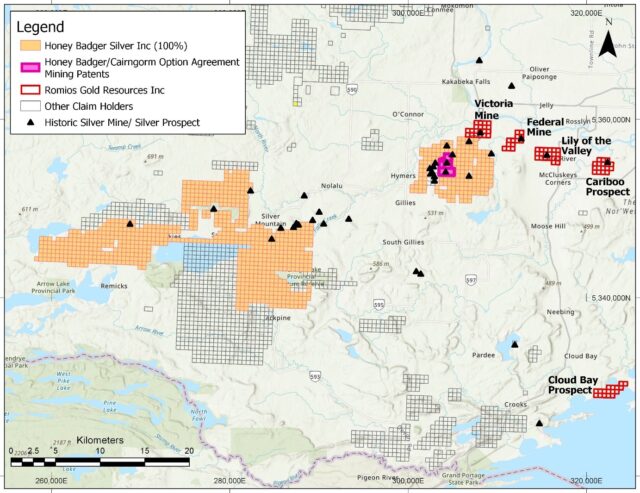

Toronto, Ontario – June 10, 2021 – Honey Badger Silver Inc. (TSX-V: TUF) (“Honey Badger Silver” or the “Company”) is pleased to announce that it has signed the Definitive Agreement (the “Agreement”) with Romios Gold Resources Inc. (“Romios Gold”; CVE: RG) to acquire an 80% interest and control of an additional 1,870 hectares (4,620 acres) in 87 mining claims covering historic silver properties in the Thunder Bay Silver District. The Agreement succeeds the Letter of Intent entered into by the parties announced on April 27, 2021.

The new claims comprise substantial portions of the historic Victoria Mine and Federal Mine silver properties, plus the Lily of the Valley, Caribou and Cloud Bay prospects.

“This acquisition solidifies Honey Badger Silver’s dominant position in this historic high-grade silver camp and furthers our strategy to create a high-value, high-growth silver company leveraging our regional positioning in world-class silver districts,” said Chad Williams, Executive Chairman.

In consideration for an 80% interest in the project, Honey Badger Silver has agreed to: a) issue shares of the Company to Romios Gold for a value of C$150,000 at a price equal to the volume weighted average price of its common shares, trading on the TSXV for the thirty trading days immediately preceding the date of the transaction’s announcement, subject to the maximum discounted price allowed under the policies of the TSXV and b) free-carry all costs and expenses related to the maintenance and advancement of the project to pre-feasibility. Immediately after completion of the pre-feasibility study, the parties shall enter into a joint venture agreement to continue advancing the project towards commercial production.

In addition, Romios Gold shall grant a right of first refusal to Honey Badger Silver on its 20% remaining interest, post-transaction. If any party is diluted to a 10% or less interest in the joint venture, such party’s interest shall be converted to a 2% net smelter return royalty with an option to buyback half for C$ 2,000,000. For further details, please refer to the aforenoted press release on the Company’s website at www.honeybadgersilver.com.

For more information, please visit our website above, or contact: Ms. Christina Slater at [email protected].

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

About Honey Badger Silver Inc.

Honey Badger Silver is a Canadian Silver company based in Toronto, Ontario focused on the acquisition, development, and integration of accretive transactions of silver ounces. The company is led by a highly experienced leadership team with a track record of value creation backed by a skilled technical team. With a dominant land position in Ontario’s historic Thunder Bay Silver District and advanced projects in the southeast and south-central Yukon, Honey Badger Silver is positioning to be a top tier silver company. The Company’s common shares trade on the TSX Venture Exchange under the symbol “TUF”.

Cautionary Note Regarding Forward-Looking Information

This News Release contains forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required.