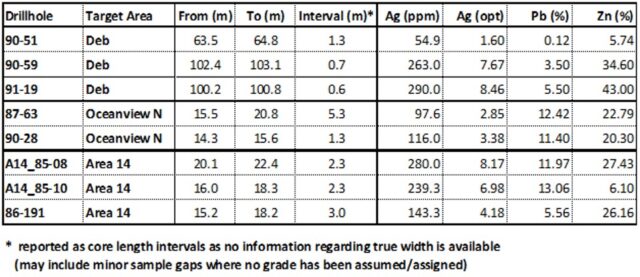

Toronto, Ontario, August 13, 2025 – Honey Badger Silver Inc. (TSXV: TUF | OTCQB: HBEIF) (“Honey Badger” or the “Company”) is pleased to provide an update from its highly promising 2025 summer field program at its 100%-owned Plata project in the Yukon.

The Company is now awaiting assays which could lead to the possibility of drilling these new targets very soon. This news release presents results obtained since the Company’s news release of a few weeks ago (July 30, 2025: “Honey Badger Discovers Promising Sheeted Veins in Multiple Zones over 18km at Plata, Yukon”) and highlights the discovery of even more ‘sheeted vein’ zones.

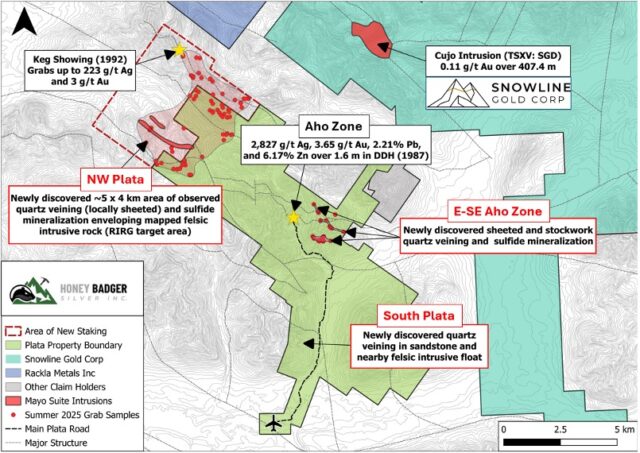

The Company’s Executive Chairman, Chad Williams, commented, “Honey Badger has discovered numerous auspicious geologic targets that absolutely merit follow up work. Plata is shaping up to be a game-changer for Honey Badger. We continue to identify many new promising geologic targets, especially on our new claims. We are particularly excited by the recognition of additional ‘sheeted vein’ zones that may indicate the presence of reduced intrusion-related gold (RIRG) systems, similar to those found at the directly adjacent Rogue project, owned by Snowline Gold (TSXV: SGD), containing 7.94M oz Au (M&I) and 0.89M oz Au (Inferred) (see SGD news release dated May 15, 2025).”

Note: The QP has not independently verified the Rogue Mineral Resource Estimate (MRE) quoted above. The Rogue MRE is not necessarily indicative of mineralization on the property that is the subject of the disclosure.

Summary

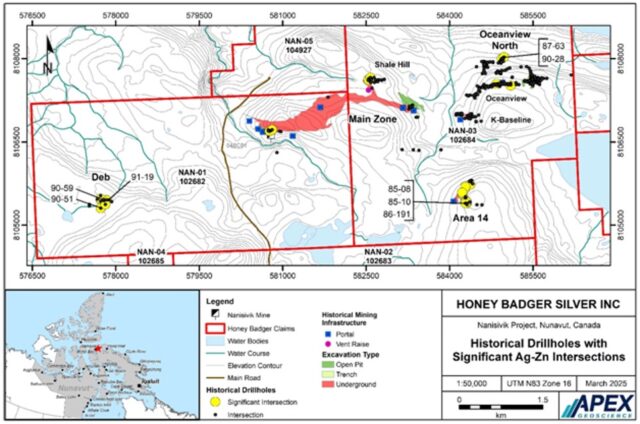

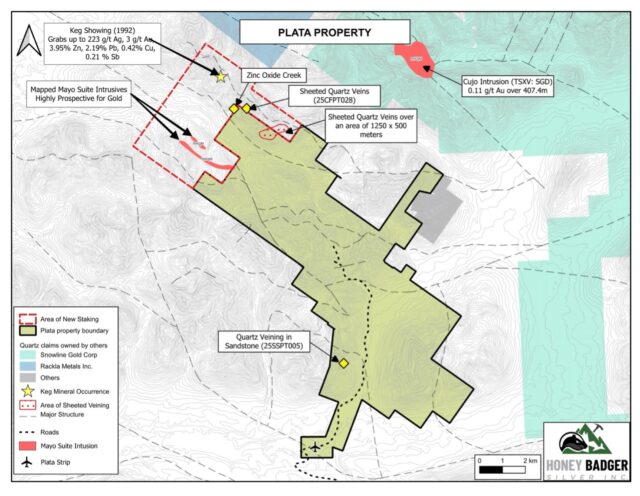

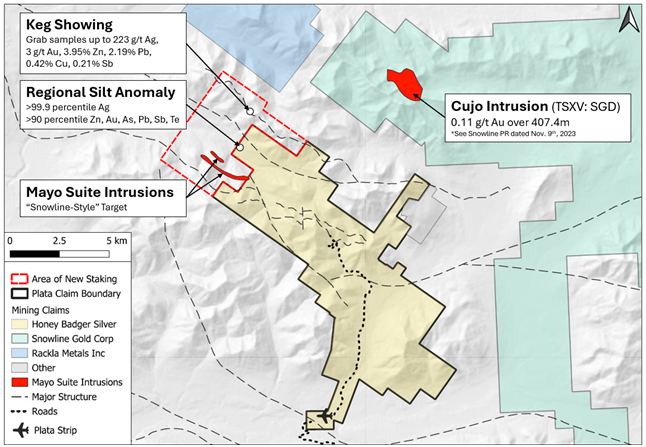

- Extended the Sheeted Vein Zone at Northwest Plata: Honey Badger has uncovered additional ‘sheeted vein’ systems, which increases the total area prospective for RIRG mineralization to ~4 x 5 km within the newly staked claim blocks, with significant potential to discover more (Fig. 1). Central to the sheeted vein systems are interpreted Mayo Suite felsic intrusions found over a 2.3 x 0.67 km area. Importantly, the team has successfully identified the western extent of the Rogue Thrust Fault in this area, a key geological boundary known to host mineralization in the region.

- Aho Zone Materially Expanded: The central claims host the high-grade, past-producing Aho silver zone. The team has uncovered an 810 x 230 m zone of quartz veining and sulfide mineralization overlapping high-grade silver geochemical anomalies (Fig. 1). Two additional zones with similar geology have also been identified near key geological structures, including the Plata and Rogue Thrust Faults.

- Geophysical Low at South Plata: Quartz veining and felsic intrusive float have been discovered at South Plata over a magnetic low geophysical anomaly. No known work has ever been completed here (Fig. 1).

Next Steps:

Assays for 102 rock samples and 568 soil samples are expected in the coming weeks. Results of these assays, coupled with further fieldwork, is expected to help guide drilling before year-end.

Figure 1: Plata property, showing the newly staked claim outline (red) and summary observations from the recent field program.

Notes: 1. The Cujo intercept is from a Snowline Gold (TSXV: SGD) News Release dated November 9, 2023. The QP has been unable to verify the information. 2. The Cujo intercept is not necessarily indicative of mineralization that may be present at the Plata project.

Geological Discussion

Key results of the recent exploration fieldwork completed at Plata since the press release of a few weeks ago (July 30th, 2025) include:

- Northwest Plata (newly staked ground)

Identification of potential Mayo-suite felsic intrusions and presence of hornfels alteration, sulfide mineralization, and quartz veining (locally sheeted) observed for over 2.7 km in strike length towards the southern claim margin (Figures 1, 2 and 3). The presence of potential Mayo-suite intrusive rock is important because of their close association with gold and silver mineralization in the region. Hornfels alteration is significant because it indicates that the host rock has been altered due to proximity to an intrusion.

- Several occurrences of felsic plutonic rock interpreted to represent Mayo Suite Intrusions were identified in both outcrop and float over a 2.3 x 0.67 km area in the newly staked ground in the northwest of the property towards the southern claim boundary. Samples of the felsic intrusive rock are noted as granodiorite to quartz porphyry and range from fresh-looking to intensely sericite and clay altered with occasional fine-grained pyrite observed (Fig. 2).

- Extensive quartz veining (locally sheeted and stockwork) with associated silicification, hornfels alteration, oxidation and sulfide mineralization has been observed within interbedded mudstones, shales, chert and lesser sandstone over a 2.7 x 2 km zone that overlaps with the mapped felsic intrusive units (Figures 2 and 3).

- Field observations in this area describe several outcrops with densely sheeted quartz veins and local stockwork textures, as well as rare chalcopyrite and malachite mineralization. Many of the field observations also highlight the presence of disseminated to stringer pyrite associated with the presence of the oxidized quartz veining (Figures 2 and 3).

- Mapped the western extension of the Rogue Thrust Fault

Mapping was continued of the interpreted Rogue Thrust Fault that separates the Mt. Christie Formation and the Earn Group. This fault represents an important structural boundary and potential mineralizing fluid pathway in this area.

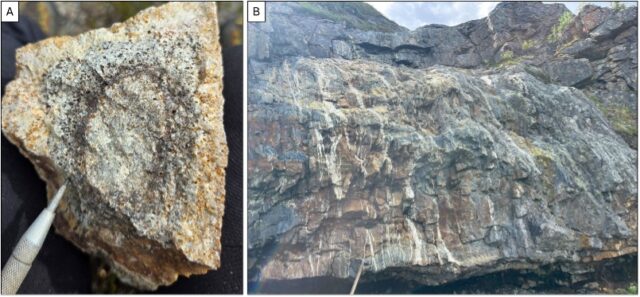

Figure 2: (A) Sericite altered granodiorite interpreted to represent Mayo Suite Intrusive rock; (B) Large outcrop of densely sheeted quartz veining with blebby chalcopyrite (<0.5%) mineralization. Veining occurs perpendicular to bedding in massive black chert of the Earn Group proximal to the mapped granodiorite intrusions in the newly staked ground in the NW of the property. Hammer (24 inches) for scale.

- East Central Plata (Aho Zone)

Discovered several new zones comprising hornfels altered and silicified host rock with associated quartz veining and sulfide mineralization to the east and southeast of the Aho Zone.

- The largest zone is an ~810 x 230 m area that partially overlaps with a historic 1000 x 300 m Ag soil anomaly with silver in soil up to 50 g/t Ag (Assessment Report 091705, by A. Harman, 1976). This zone includes silicified and hornfels altered mudstones, siltstones and chert with quartz veining, disseminated and stringer pyrite, as well as local galena and sphalerite stringers and blebs.

- Another zone beginning ~900 m to the east of the Aho zone in proximity to the Plata Thrust Fault extends for approximately 1.1 km towards the eastern claim boundary and comprises a series of limestone, shale, and sandstone outcrops hosting extensive sheeted and stockwork quartz-calcite veining with associated oxidation (Fig. 3).

- Yet another zone comprising several outcrops hosting oxidized sheeted and stockwork quartz veining was observed to the northeast of the Aho Zone in proximity to the Rogue Thrust Fault.

- Mapped eastern extensions of the Plata and Rogue Thrust Faults

Extended both the Plata and Rogue Thrust Faults to the East of the Aho Zone, which is an ~800 m long zone of semi-continuous high-grade silver, gold, zinc and lead mineralization present along the Plata Thrust Fault.

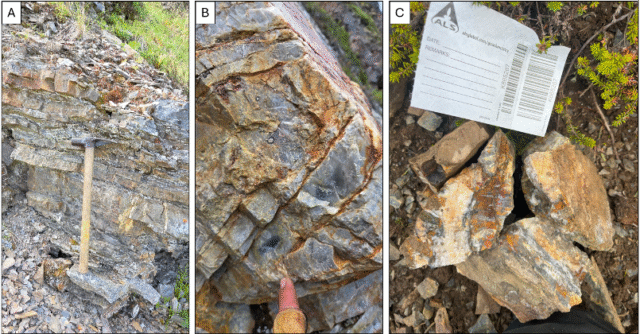

Figure 3: (A) Oxidized quartz veining hosted in hornfels altered siltstone of the Mt. Christie Formation collected adjacent to the mapped felsic intrusive units in the NW of the property; (B) Strong recrystallization of originally black chert interpreted to represent hornfels alteration due to proximity to mapped intrusive units in the NW of the property; (C) Quartz veining with associated strong oxidation and fine-grained (galena?) sulfide veinlets hosted in a chert outcrop SE of the Aho Zone.

Major Takeaways of the Completed Summer Field Work Program:

- A total of 102 rock samples and 569 soil samples were taken during this initial program. Assays are pending.

- Confirmed the presence of felsic plutonic rocks interpreted to be Mayo Suite Intrusions occurring throughout the newly staked ground in the northwest of the property (Fig. 1).

- Newly discovered extensive sheeted quartz veins with associated oxidation and sulfide mineralization throughout all traversed areas in the recently staked ground in the northwest of the property that defines a new highly prospective area for potential RIRG mineralization at least 5 x 4 km in size (Fig. 1).

- Discovery of local quartz veining and felsic intrusive float within newly staked ground in 2024 over a magnetic low geophysical anomaly in the south end of the property (Fig. 1).

- Identified several new zones comprising hornfels altered and silicified host rock with associated oxidized quartz veining and sulfide mineralization to the east and southeast of the Aho Zone (Fig. 1).

- Mapped extensions of the mineralized Plata and Rogue Thrust Faults to the West and East.

About Plata

Plata is located in east-central Yukon within the Tombstone Gold Belt and is a past producing high-grade silver property that produced about 290,000 ounces of silver (Ag) from small-scale mining of high-grade veins that are exposed at surface (Carlson, G.G., 2010, “Technical Report Describing Exploration and Development at the Plata Project, located in the Mayo Mining District, East-Central Yukon”, report prepared for Platoro West Holdings Inc.). Ore was mined and flown by fixed wing aircraft to Idaho for processing. Historical exploration at Plata has primarily focused on the outcropping high-grade silver veins. These are analogous to the rich Keno Hill Silver Mine in the Yukon, one of the highest-grade silver deposits in the world, now operated by Hecla Mining. While the analogy to Keno Hill remains valid, the Company has continued to develop its understanding of Plata as part of a larger “Snowline-style” mineralized system. Understanding how Plata might fit into a Reduced Intrusion Related Gold System (RIRGS) like Snowline Gold’s Rogue and Valley deposits adds the potential for a large gold deposit in addition to the high-grade silver vein potential.

Qualified Person

Technical information in this news release has been approved by Dorian L. (Dusty) Nicol (PG, FAusIMM), a director and technical advisor of the Company, who is a Qualified Person (QP) for the purpose of National Instrument 43-101.

About Honey Badger Silver Inc.

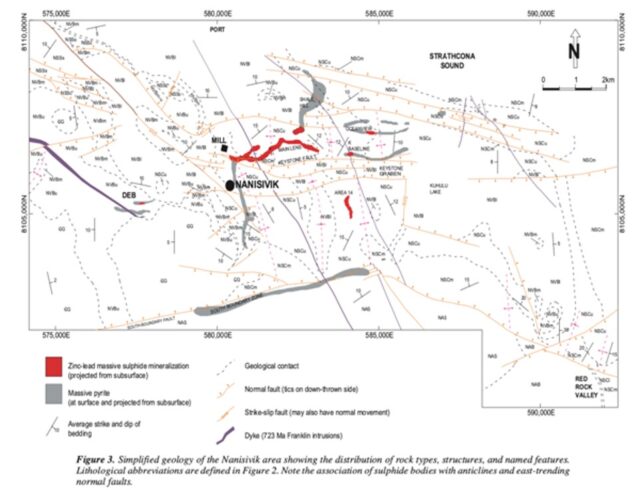

Honey Badger Silver is a silver company. The company is led by a highly experienced leadership team with a track record of value creation backed by a skilled technical team. Our projects are located in areas with a long history of mining, including the Sunrise Lake project with a historic resource of 12.8 Moz of silver at a grade of 262 g/t silver (and 201.3 million pounds of zinc at a grade of 6% zinc) Indicated and 13.9 Moz of silver at a grade of 169 g/t silver (and 247.8 million pounds of zinc at a grade of 4.4% zinc) Inferred(1) located in the Northwest Territories and the Plata high grade silver project located 165 km east of Yukon’s prolific Keno Hill and adjacent to Snowline Gold’s Rogue discovery. The Company’s Clear Lake Project in the Yukon Territory has an unclassified historic resource of 5.5 Moz of silver at a grade of 22 g/t silver and 1.3 billion pounds of zinc at a grade of 7.6% zinc(2). The Company also has a significant land holding at the Nanisivik Mine Area located in Nunavut, Canada that produced over 20 Moz of silver between 1976 and 2002(3). A qualified person has not done sufficient work to classify the foregoing historical resources as current mineral resources, and the Company is not treating the estimates as current mineral resources. The historical resource estimates are provided solely for the purpose as an indication of the volume of mineralization that could be present. Additional work, including verification drilling / sampling, will be required to verify any of the historical estimates as a current mineral resources.

(1) Sunrise Lake 2003 RPA historic resource: Indicated 1.522 million tonnes grading 262 grams/tonne silver, 6.0% zinc, 2.4% lead, 0.08% copper, and 0.67 grams/tonne gold and Inferred 2.555 million tonnes grading 169 grams/tonne silver, 4.4% zinc, 1.9% lead, 0.07% copper, and 0.51 grams/tonne gold.

(2) Clear Lake 2010 SRK historic Resource: Inferred 7.76 million tonnes grading 22 grams/tonne silver, 7.6% zinc, and 1.08% lead.

(3) Geological Survey of Canada, 2002-C22, “Structural and Stratigraphic Controls on Zn-Pb-Ag Mineralization at the Nanisivik Mississippi Valley type Deposit, Northern Baffin Island, Nunavut; by Patterson and Powis.”2) Clear Lake 2010 SRK historic Resource: Inferred 7.76 million tonnes grading 22 grams/tonne silver, 7.6% zinc, and 1.08% lead.

ON BEHALF OF THE BOARD

Chad Williams, Executive Chairman

Sonya Pekar

Investor Relations

[email protected] | +1 (647) 498-8244

For more information please visit our website www.honeybadgersilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Honey Badger to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Such factors include, but are not limited to, risks relating to capital and operating costs varying significantly from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR+ (www.sedarplus.ca) under Honey Badger’s issuer profile. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed timeframes or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.