TORONTO, July 8, 2021 – Honey Badger Silver Inc. (TSX-V: TUF) (“Honey Badger Silver” or the “Company”) is pleased to announce that it has engaged Archer, Cathro & Associates (1981) Limited (“Archer Cathro”) to oversee the Phase 1 work program on its 100%-owned 5,690 hectare Plata Silver Property (“Plata”) located in east-central Yukon. Archer Cathro is the established leader in Yukon mineral discoveries.

The Plata Silver Property lies within the Tintina Gold Belt and displays a number of similarities to the world-class Keno Hill Silver Mining Camp, Canada’s second largest primary producer of silver with production from approximately thirty-five vein deposits between 1913 and 1989.

Plata Property Highlights:

- Historic surface trenching and shallow drilling has identified thirty-two (32) known mineralized zones, comprising high-grade silver, gold, lead and zinc-bearing veins and stockwork zones;

- Several areas of the property were mined historically for high-grade silver and yielded 9,020 kg (290,000 oz) of silver from a reported 2,041 tonnes of hand sorted material, equivalent to a recovered silver grade of approximately 4,420 grams per tonne (g/t) silver.

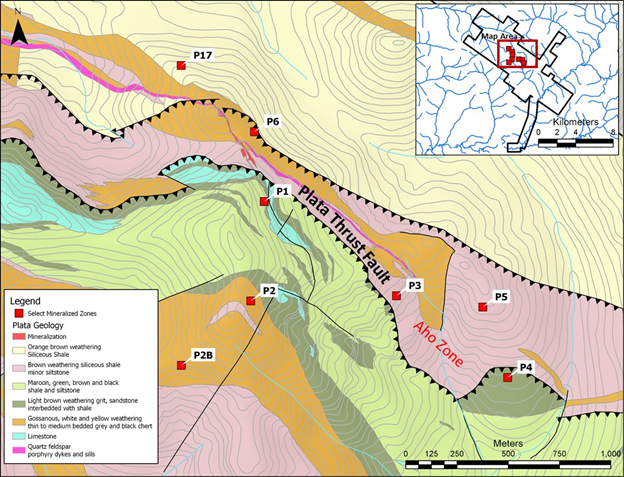

Historic drilling to date has demonstrated potential for continuous mineralization over a strike length of nearly 800 metres at the Aho Zone (Figure 1). This zone is a semi-continuous mineralized system developed within the plane of the Plata Thrust Fault that extends intermittently over a total strike length of 800 metres and to a maximum of 580 metres downdip and remains open to extension along strike and downdip.

About the Plata Silver Property

Historic exploration at the Plata Silver Property from 1969 to 2011 identified thirty-two (32) known mineralized zones, extending over a 2.5 kilometre area, hosting narrow high-grade silver, gold, lead and zinc-bearing veins and stockworks. Mineralization at Plata is believed to be associated with hydrothermal fluids related to the Tombstone intrusive suite and bears similarities to the prolific Keno Hill Silver Mining Camp, Canada’s second largest primary producer of silver with production from approximately thirty-five (35) vein deposits between 1913 and 1989.

High priority target areas at Plata include:

- P-4 Zone: The P-4 Zone has undergone more extensive drilling relative to other targets at Plata and demonstrates continuous mineralization over 200 metres of strike length that remains open in all directions. Average grades and widths from fourteen (14) core drill holes in 1987 were 1.9 metres grading 337 g/t silver, 3.65 g/t gold, 1.59% lead and 1.7% zinc.

- P-3 Zone: At the P-3 Zone, rock samples have returned extremely high gold assays (up to 78.3 g/t) and chip sampling returned 1.96 metres grading 2,383 g/t silver, 9.85 g/t gold and 7% lead.

- P-6 Zone: Drilling in 2011 confirmed the continuity of significant polymetallic silver mineralization at depth and laterally over a strike length of 150 metres. Highlighted drill intercepts include 1.0 metre grading 1,655 g/t silver and 1.09% zinc, and 6.63 metres grading 164 g/t tonne silver and 2.34% zinc. Veining mapped at surface and anomalous soil geochemistry suggest the P-6 structure may extend for 500 metres to the northwest.

- P-2 Zone: Detailed trenching of the P-2 Zone returned a weighted average of 812 g/t silver, 24.48% lead and 17.02% zinc across an average width of 1.93 metres for a strike length of 85 metres. Drill holes targeting the P-2 Zone yielded intercepts of up to 1,060 g/t silver and 3.86% zinc over 0.87 metres and 110 g/t silver and 39.77% zinc over 0.93 metres.

Importantly, drilling from 2008 to 2011 has demonstrated that the P-3 and P-4 veins are part of a larger, semi-continuous, mineralized system referred to as the Aho Zone, which is developed within the plane of the Plata Thrust Fault and varies from 0.3 to 3.0 metres in width. This zone extends intermittently over a total strike length of 800 metres and to a maximum of 580 metres downdip and remains open to extension along strike and downdip (Figure 1).

Plata Phase 1 Program:

The primary objective of the Phase 1 program planned for this summer by Archer Cathro is to complete detailed mapping and rock and channel sampling at a number of priority target zones at Plata in order to better understand structural controls of silver mineralization. This will provide valuable insight for eventual drill hole targeting.

The secondary objective of the Phase 1 program will be to better define the full extent of mineralization at Plata. Towards this end, soil grids will be completed in previously unsampled areas to more thoroughly define anomalous geochemical zones and trends.

Technical information in this news release has been approved by Heather Burrell, P.Geo., a geologist with Archer, Cathro & Associates (1981) Limited and qualified person for the purpose of National Instrument 43-101.

Closing of First Tranche of Flow-Through Private Placement

The Company also announces that it has closed the first tranche of its ongoing non-brokered flow-through private placement (the “FT Offering”) by issuing 1,681,800 Flow Through Shares (‘FT Shares”) at a price of $0.15 per FT Share for gross proceeds of $252,270. The gross proceeds from the Offering will be used to fund the exploration program on the aforenoted Plata silver property and future exploration programs on the Company’s other properties in the Yukon as well as the Thunder Bay District of northern Ontario, which qualify as flow-through shares for purposes of the Income Tax Act (Canada).

The Company expects to close a second and final tranche of the FT Offering shortly.

In connection with the foregoing, the Company paid finders’ fees totalling $17,239 and issued non-transferable purchase warrants entitling the purchase a total of 114,926 common shares of the Company at a price of $0.15 per share for a period of 24 months following the closing. All securities issued in connection with the FT Offering are subject to a hold period of four months plus a day from the closing. The FT Offering remains subject to the final approval of the TSX Venture Exchange.

For more information, please visit our new website at https://www.honeybadgersilver.com.

Or contact: Ms. Christina Slater at [email protected].

About Honey Badger Silver Inc.

Honey Badger Silver is a Canadian silver company based in Toronto, Ontario focused on the acquisition, development, and integration of accretive transactions of silver ounces. The company is led by a highly experienced leadership team with a track record of value creation backed by a skilled technical team. With a dominant land position in Ontario’s historic Thunder Bay Silver District and advanced projects in the southeast and south-central Yukon, Honey Badger Silver is positioning to be a top tier silver company.

The Company’s common shares trade on the TSX Venture Exchange under the symbol “TUF”.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release contains forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required.