Honey Badger toAcquire 100% of the CachinalSilver-GoldProject in Chile, with 16.3 Million Ounces of Indicated and 2.5 Million Ounces of Inferred Silver Resources

Toronto, Ontario – June 13, 2022 – Honey Badger Silver Inc. (TSX-V: TUF) (“Honey Badger” or the “Company”) is pleased to announce that it has entered into a non-binding term sheet (the “Term Sheet”) to acquirefrom Aftermath Silver Ltd. (“Aftermath”) its100% interest in the Cachinal De La Sierra Silver-Gold Project (the “Cachinal Project” or “Cachinal”), located in the Cachinal de la Sierra areain Chile’s Antofagasta region(Region II). The proposed transaction includes an exclusivity period that ends on August 15, 2022. Honey Badger and Aftermath are working diligently to finalize a definitive agreement on or before this date.

Cachinal Project Highlights

- Open-pitIndicated Resource of 15.03 Mozof silver grading 97 g/t of silver and 20.05Koz of gold grading 0.13 g/t gold;

- Open-pit Inferred Resource of 0.41 Mozof silver grading 73 g/t of silver and 0.43Koz of gold grading 0.07 g/t gold;

- Underground Indicated Resource of 1.29 Moz of silver grading 182 g/t of silver and 1.65Koz of gold grading 0.22 g/t gold;

- Underground Inferred Resource of 2.07 Moz of silver grading 180 g/t of silver and 2.18Koz of gold grading 0.19 g/t gold;

- Proximity to Austral Gold Limited’s (“Austral Gold”) operating Guanaco Mine and Mill complex, located just 16 kmto the south;

- Good potential to confirm and incrementally expand existing resources and discover additional mineralization on the property and in the region.

The mineral resource was independently prepared by SRK Consulting (Canada) Inc. in a technical report filed on Aftermath’s SEDAR profile at www.sedar.com, with an effective date of August 10, 2020 and prepared in accordance with National Instrument 43-101 – Standards ofDisclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”).

Chad Williams, Director and Non-Executive Chair of Honey Badger stated, “We are very pleased to announce a further accretive addition to our growing portfolioof silver assets. Cachinal isa significant known silver resource located in a favorable jurisdiction. Moreover, its proximity to Austral’s Guanaco mine and mill complex may offer substantial synergies to advancing Cachinal to production in a timely manner. We believe Cachinalwill be transformational for Honey Badger.

We were also greatly encouraged and inspired by arecent speechdelivered byH.E. Gabriel Boric, President of the Republic of Chile, at an event hosted by the Canadian Council for the Americas. During this event, Mr. Boric strongly signalled his commitment to property rights, and the rule of lawin addition to welcoming direct foreign investment. Chile’s long-standingpartnership with Canada to generate economic growth and jobs for all was reiterated in meetings with Prime Minister Trudeau during his visit.”

Transaction Summary

The Term Sheetcontemplates that Honey Badgeror anaffiliate will acquire all of the issued and outstandingshares of Minera Cachinal S.A., a wholly-owned subsidiary of Aftermath,according to the following terms:

- Share Payment: C$1,000,000in sharesof Honey Badger payable at closingand priced atthe greater of: (i) the volume weighted average share price of the Honey Badger common shares on the TSXV for a period of thirty (30) trading days immediately preceding the date of announcement of the transaction and (ii) the maximum discounted price allowed under the policies of the TSXV.

- Cash Payments: a)C$400,000 payable at closing, b) C$452,000 six months after closing, c)C$400,000 on May 21, 2023 and d) C$400,000 eighteen months after closing.

- Royalty: Honey Badger shall grant a 1% Net Smelter Return Royalty with a complete buyback option at Honey Badger’s sole discretion for a purchase price of C$8,500,000;

- Production Payments: Upon commencement of commercial production, Honey Badger shall pay in cash or shares at Aftermath’s option, C$0.50 per payable silver ounce produced at the Cachinal Project, capped at C$2,000,000 in payments.

The detailed terms and conditions of the proposed transaction will be set out in definitive documentation to be negotiated between the parties, which will contain customary representations, warranties and covenants of the parties as well as customary indemnities and closing conditions. There can be no assurance that the proposed transaction will be completed on the terms contemplated, or at all. Readers are referred to the section below entitled: “Cautionary Note Regarding Forward-Looking Information”.

While the Term Sheet is non-binding, the parties have agreed to a mutual break fee of C$250,000 in the event a definitive agreement is not entered into prior to the expiry of the exclusivity period due to a party’s action or inaction, subject to certain exceptions outside the control of the parties. The proposed transaction will be subject to regulatory approval, including the approval of the TSX Venture Exchange (the “TSXV”).

CachinalAsset Overview

Cachinal is a low-sulphidation epithermal deposit located in the Paleocene Gold Belt of northern Chile, which hosts several significant gold and silver deposits, including Yamana Gold’s El Penon Low Sulfidation Epithermal gold–silver mine and Austral Gold’s Guanaco gold-silver mine-complex, just 16 kilometers to the south. Shallow drilling at Cachinalhas defined the current mineral resources principally to a depth of 150 metres below surface and provides sufficient evidence to interpret the presence of high-grade shoots within the vein system extending below the base of a potential open pit.

Cachinal Location

The Cachinal silver-gold project is located in Chile’s Antofagasta region(Region II). The project is located about 40 kmeast of the Pan AmericanHighway, in a nearly flat plain at an elevation of around 2,700 metres above sealevel, 16 km north of Austral Gold’s Guanaco gold-silver mine and mill complex.

CachinalNI 43-101 Resource Estimate

The CachinalMineral Resource was documented in a technical report prepared following theguidelines of NI 43-101 and Form 43-101F1, and in conformity with the generally accepted CIM “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines” (2019) by SRK Consulting (Canada) Inc.,authored by independent qualified persons Glen Cole,P.Geoof SRK Consulting, and Sergio Alvarado Casas, CMC of Geoinvest SAC E.I.R.L. (Chile), on behalf of Aftermath Silver Ltd., with an effective date of August 10, 2020.

| RESOURCE Classification | material type | tonnes (mt) | silver (g/t) | gold (g/t) | silver (moz) | gold (Koz) | ||||

| Indicated | Open Pit | 4.83 | 97 | 0.13 | 15.03 | 20.05 | ||||

| Underground | 0.22 | 182 | 0.22 | 1.29 | 1.65 | |||||

| TOTAL | 5.05 | 101 | 0.13 | 16.32 | 21.70 | |||||

| Inferred | Open Pit | 0.17 | 73 | 0.07 | 0.41 | 0.43 | ||||

| Underground | 0.36 | 180 | 0.19 | 2.07 | 2.18 | |||||

| TOTAL | 0.53 | 145 | 0.15 | 2.48 | 2.61 | |||||

Notes on the Cachinal Mineral Resource Estimate:

- For completedetails on the Cachinal Mineral Resource estimate, please refer to the NI 43-101 technical report titled “Independent Technical Report for the Cachinal Silver-Gold Project, Region II, Chile”, by Qualified Persons G. Cole, (P.Geo) of SRK Consulting (Canada) Inc. and S. Alvarado Casas, of Geoinvest SAC E.I.R.L. (Chile), dated September 11, 2020 with an effective date of August 10, 2020, filed on the Aftermath Silver SEDAR profile.

- Cachinal mineral resources were classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014).

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- All figures have been rounded to reflect the relative accuracy of the estimates.

- Cut-off grades are based on metal price assumptions of US$22.00 / ounce of silver and US$1,550 / ounce of gold, and metallurgical recoveries of 85% for both silver and gold using milling and cyanide leaching.

- The portion of the Mineral Resources that has been determined to be amenable to extraction through open-pit methods was reported to a cut-off of 30 g/t silver equivalent.

- The open-pit Mineral Resource is constrained within Lerchs-Grossman optimised pit shells that assume mining dilution & losses of 2.5%, 50-degree overall slope angles, mining costs of $2/t rock, general and administrative costs of $2/t rock, processing costs of US$15/t for processing using milling and cyanide leaching.

- The portion of the Mineral Resources deemed to be amenable to extraction through underground methods are reported at a cut-off of 150 g/t silver equivalent. This assumes a mining cost of US$90/t, general and administrative costs of $2/t and a processing costs of US$15/t.

Past Work at Cachinal

The Cachinal deposit was mined from underground workings during the 20th century. Drilling by previous owners of the project since 2005 has delineated near-surface silver mineralization associated with a network of steeply dipping, north-to-northwest trending low-sulphide quartz veins.

The epithermal veins and breccias have been recognized by trenching and drilling over a strike length of at least 2 kilometers and are known to have been mined to a depth of at least 300meters. They range in thickness from a few centimetres to 2meters, reaching up to 20meters locally at the intersection of two structures. The main veins trend north-northwest and northwest with a secondary set trending east-northeast to east-west, best developed at the southern end of the deposit.

Technical information in this news release has been approved by Glen Cole, P.Geo., a Principal Consultant (Resource Geology) with SRK Consulting (Canada) Inc. and qualified person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Chad Williams

Director and Non-Executive Chair

About Honey Badger Silver Inc.

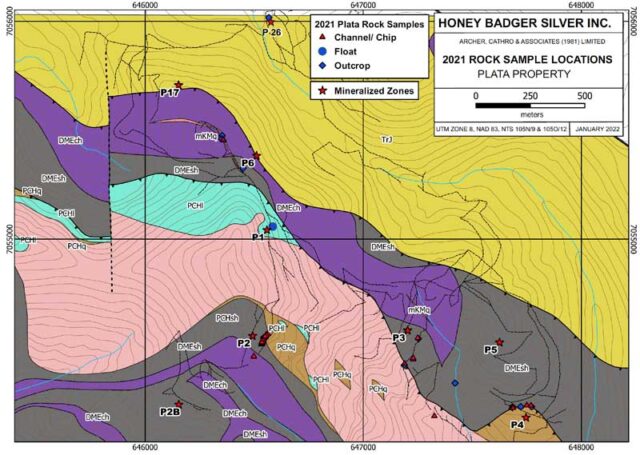

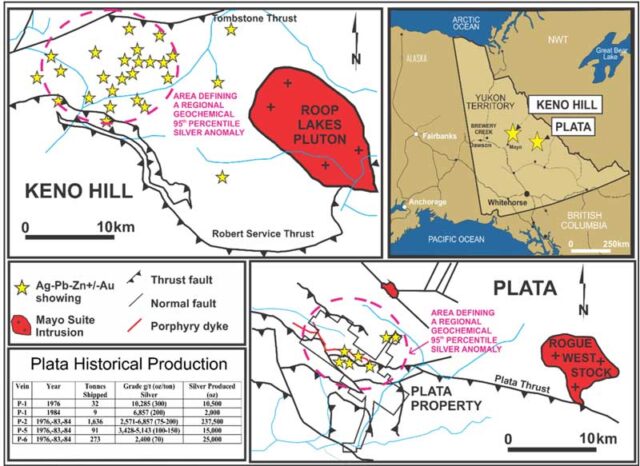

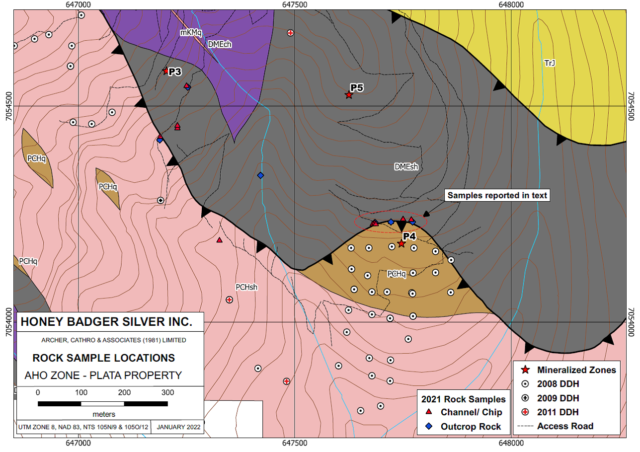

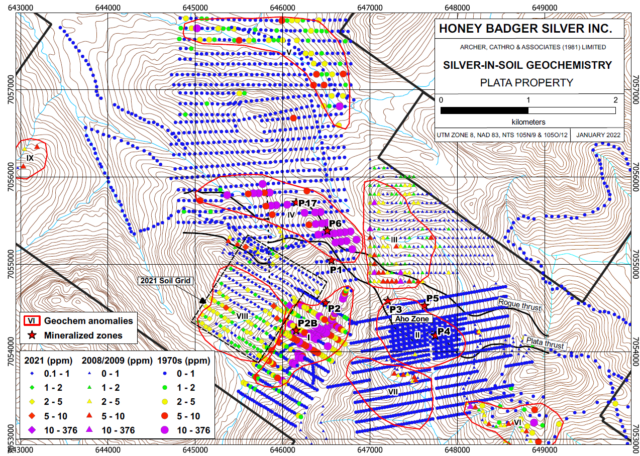

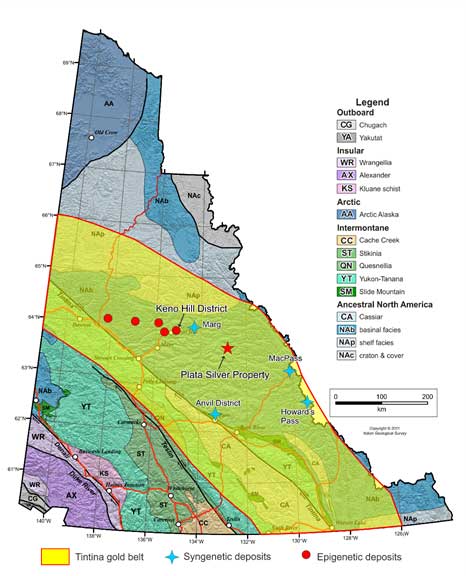

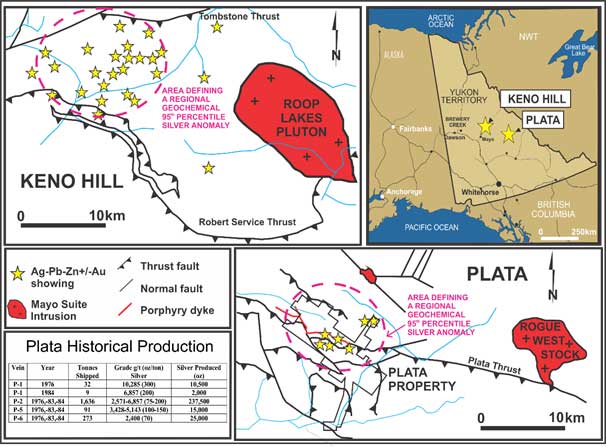

Honey Badger Silver is a Canadian Silver company based in Toronto, Ontario focused on the acquisition, development and integration of accretive transactions of silver ounces. The company is led by a highly experienced leadership team with a track record of value creation backed by a skilled technical team. With a dominant land position in Ontario’s historic Thunder Bay Silver District and advanced projects in the southeast and south-central Yukon including the Plata property 180 kms to the east of the Keno Hill silver district, Honey Badger Silver is positioning to be a top-tier silver company.

For more information, please visit our website above, or contact:

Ms. Christina Slater: [email protected]

(647) 848-1009

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release and any other information herein that is not a historic fact may be “forward-looking information”. Forward-looking information are often identified by terms such as “may”, “should”, “anticipate”, “will”, “estimates”, “believes”, “intends”, “expects”, and similar expressions which are intended to identify forward-looking information as such. More particularly and without limitation, this news release contains forward-looking information concerning the proposed acquisition by the Company of the Cachinal Project, the proposed consideration and structure of such acquisition (including the mutual break fee payable in certain circumstances), and the ability of the parties thereto to complete the proposed transaction on the terms and timelines agreed. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, no assurance can be given that such events will occur in the disclosed timeframes or at all. The Company cautions that all forward-looking information is inherently uncertain, and that actual performance may be affected by a number of material factors, assumptions and expectations, many of which are beyond the control of the Company, including: risks relating to failing to negotiate the definitive documentation concerning the proposed acquisition of Cachinal on the terms expected or at all; risks relating to the potential payment of the break fee in certain circumstances; risks relating to inability to secure necessary third-party consents or regulatory or other governmental approvals on a timely basis, or at all; general political risks and risks relating to changing laws, risks inherent with uncertain economic conditions, among other risks and uncertainties. Accordingly, the reader is cautioned not to place undue reliance on any forward-looking information contained in this news release. The forward-looking information contained in this news release are made as of the date hereof, and the Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.