Toronto, Ontario, February 9, 2026 – Honey Badger Silver Inc. (TSXV: TUF | OTCQB: HBEIF) (“Honey Badger” or the “Company”) is pleased to share that the company has recognized additional critical minerals potential at its 100%-owned Hy project in the Yukon, including high values of indium, bismuth, copper, and tungsten across several zones at the property.

The Company’s Executive Chairman, Chad Williams, commented, “We are excited to showcase more important critical mineral potential within the Honey Badger project portfolio, this time at our 100% owned Hy property. With increasing demand for building a domestic supply chain of critical minerals in Canada, we continue to leverage assay data from all our properties, and Hy is no exception. We have identified, for the first time, several untested zones containing very high values of indium, bismuth, copper, and tungsten along with high-grade silver, lead and zinc. The Hy property is also road accessible, making the added critical mineral potential even more attractive when considering the known silver potential. We are very excited for future work to be completed at Hy. Based on the public data of similar properties in other mining companies, we believe that Honey Badger’s market capitalization can be justified by Hy alone. Significantly, we have 6 other 100%-owned, silver-rich properties, including 3 that are more advanced and contain historic established mineral resources totaling approximately 150 million AgEq ozs, plus another property called Plata which is the single best exploration target that I have seen in my career.”

Background on Hy

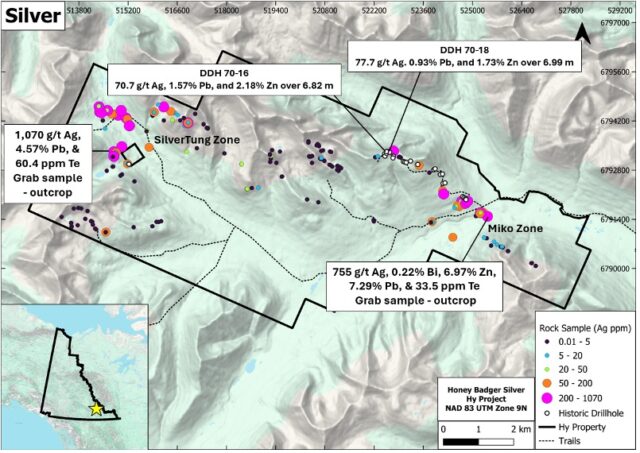

The Hy project is a road-accessible, 7,160 ha land package located approximately 150km north of Watson Lake, Yukon in the prolific Selwyn Basin (Fig. 1). The property hosts several zones of high-grade silver-lead-zinc skarn mineralization related to the intrusion of Cassiar suite felsic intrusive rock into reactive carbonate host rock. Skarn assemblages are known to occur up to 30m in width and often contain multiple lenses of mineralization throughout. Despite proven mineralization from historic drill intercepts such as 77.7 g/t Ag, 0.93% Pb, and 1.73% Zn over 6.99m (DDH 70-18) and 70.7 g/t Ag, 1.57% Pb, and 2.18% Zn over 6.82m (DDH 70-16), there has been no drilling completed at the property since 1980. Since then, exploration at Hy has focused on adding new targets and developing the geological model using a combination of detailed field mapping, prospecting, soil sampling, as well as magnetic and EM data, resulting in the identification of new breccia-hosted and fracture-controlled targets that differ from the traditional skarn model. Many of these new targets, as well as many historic targets have never seen any drilling. A recent review of historic property reports and assay data in the context of critical mineral potential has identified widespread, high-grade values of indium, bismuth, copper and tungsten, as well as tellurium, which now give the Hy property an important additional layer of exploration optionality and economic importance.

Figure 1. Distribution of rock sample grades for silver (Ag) across the Hy project, Yukon. Inset map in the bottom left corner shows the approximate location of the Hy project within the Yukon.

Critical Minerals Potential

Although there has been some sporadic mention of rare minerals at Hy in historic assessment reports, this is the first time that Honey Badger Silver has documented the presence of these minerals through a re-evaluation of assay data and as a focused critical minerals opportunity. The identification of high-grade indium, bismuth, tungsten, copper, and tellurium adds a compelling layer of critical minerals potential to the established silver-lead-zinc skarn mineralization at Hy. Indium, bismuth, tungsten, and tellurium are globally scarce elements critical to semiconductors, advanced alloys, renewable energy technologies, and high-performance electronics. The Hy dataset reports elevated values including up to 179.5 ppm indium, bismuth exceeding the analytical upper detection limit of 1.0% (not reanalyzed and therefore representing a minimum value), 0.27% tungsten oxide (WO₃), and up to 171 ppm tellurium. These are high concentrations for these rare critical minerals, especially in a district better known for precious and base metals. In a time of strong global demand driven by the clean energy transition, and advanced manufacturing, this diversification strongly enhances Hy’s strategic value and upside for future exploration and development in the Yukon.

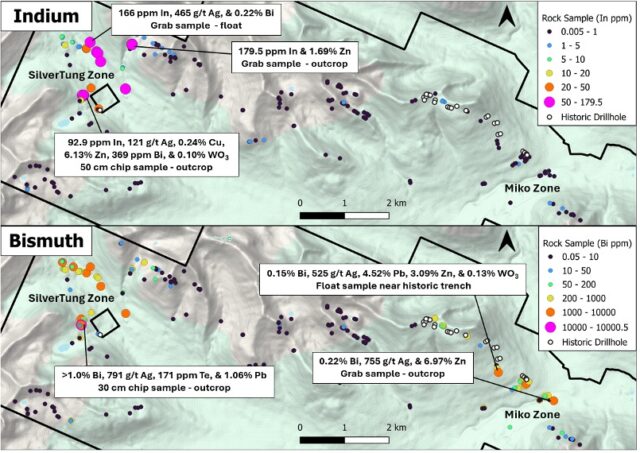

Indium (In)

The highest indium grade recorded at Hy is 179.5 ppm In, collected from outcrop in the northern SilverTung zone (Fig. 2). Samples with high indium values above 50 ppm comprise a tight ~1.5 x 1.5 km area around the SilverTung zone within the northwestern corner of the property. Out of 276 samples, 34 exceed grades of 10 ppm In, and 19 exceed grades of 50 ppm In.

Bismuth (Bi)

The highest recorded bismuth value returned an overlimit value of >1.0% Bi, collected from a 30 cm chip sample from outcrop in the southern SilverTung zone, along with 791 g/t silver (Fig. 2). Similar to indium, samples with high bismuth values over 1000 ppm form a fairly tight ~1.5 x 1.5 km cluster around the SilverTung zone within the northwestern corner of the property, but also comprise a ~1.5 km long northwest-southeast trend at the Miko zone, in addition to a string of elevated values above 200 ppm Bi to the northwest of Miko near the bulk of historic drillholes. Of the 276 samples, 50 samples contain bismuth grades above 200 ppm, and 14 samples exceed grades of 1,000 ppm.

Figure 2. Distribution of rock sample grades for indium (top), and bismuth (bottom) across the Hy project, Yukon.

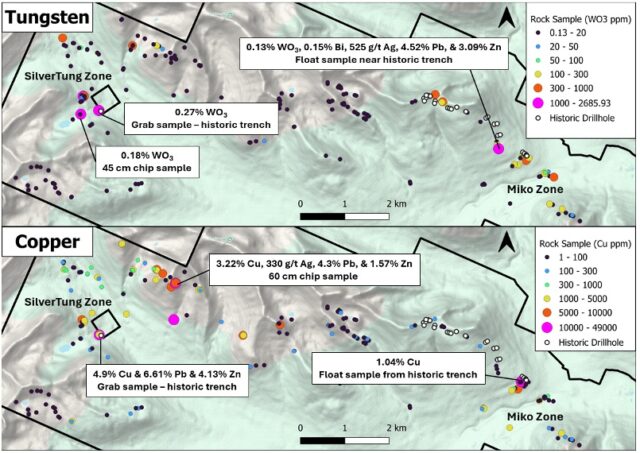

Tungsten (WO3)

The highest tungsten grade reported is 0.27% WO3, collected in a grab sample from a historic trench in the southern SilverTung zone (Fig. 3). Several other high tungsten values over 0.1% are also from the southern SilverTung zone, with some values >300 ppm sporadically occurring to the north. High tungsten values also overlap with high bismuth values that comprise a ~1.5 km long northwest-southeast trend in the Miko zone, with some elevated tungsten values also in samples to the northwest. Out of 276 samples, 19 contain tungsten grades above 300 ppm, and 6 contain grades over 1,000 ppm.

Copper (Cu)

The highest reported copper grade of 4.9% Cu is from a sample collected in the southern SilverTung zone (Fig. 3). Copper grades are more variably distributed across the Hy property, but areas such as the southern SilverTung zone, northeastern SilverTung zone, and Miko zone show more consistent high-grade samples generally above 1000 ppm Cu. Out of 276 samples, 17 contain grades above 0.5% Cu (5,000 ppm), and 7 exceed grades above 1.0% Cu (10,000 ppm).

Figure 3. Distribution of rock sample grades for tungsten (top), and copper (bottom) across the Hy project, Yukon.

Next Steps

Although future work at Hy will continue to focus on the silver potential, recognizing the presence and high-grade nature of the critical minerals shown above is a massive added layer of optionality at the project. Coupled with the fact that the project is road-accessible, the Hy project presents an exceptional opportunity to explore for classic skarn-related silver-lead-zinc mineralization, with potential to add substantial value through the presence of these rare critical minerals that occur with the silver. Areas where these minerals are concentrated such as the SilverTung and Miko zones are largely unexplored with minimal or no drilling and will be the focus of future exploration work.

QAQC

Rock Samples

Grab samples and chip samples of rocks are selective by nature and are collected to characterize mineralization and confirm the presence of target elements. Grab and chip samples are inherently selective and may not be representative of the overall or underlying mineralization on the property.

The rock samples reported above were collected between 2013 and 2015. Sample preparation and multi-element analyses for rock samples were carried out at ALS Minerals’ laboratories in Whitehorse, Yukon, and North Vancouver, BC, respectively. Upon receipt at the laboratory, samples were weighed and logged in. Samples were then dried and fine crushed to better than 70% passing 2 mm. Crushing quality control testing was performed by ALS as part of their internal QA/QC procedures. A representative split of each sample was obtained using a riffle splitter. The split was then pulverized to 85% passing 75 microns, with pulverizing quality control testing conducted by ALS.

All samples were subjected to a four-acid digestion and analyzed for a 48-element suite by ICP-MS using ALS method ME-MS61.

Ore-grade elements were analyzed as follows:

- Silver (Ag) – Four-acid digestion with ICP-AES finish (Ag-OG62)

- Copper (Cu) – Four-acid digestion with ICP-AES finish (Cu-OG62)

- Lead (Pb) – Four-acid digestion with ICP-AES finish (Pb-OG62)

- Zinc (Zn) – Four-acid digestion with ICP-AES finish (Zn-OG62)

For samples collected in 2013 only:

- Over-limit values for lead were reanalyzed using method Pb-VOL70, a volumetric titration procedure. Gold was analyzed using a 30 g fire assay with ICP-AES finish (Au-ICP21).

Quality control is maintained by ALS through the insertion of blanks, standards, and duplicates in accordance with their internal QA/QC protocols.

Qualified Person

Technical information in this news release has been reviewed and approved by Benjamin Kuzmich, P. Geo., a consultant, who is a Qualified Person (QP) for the purpose of National Instrument 43-101 “Standards of Disclosure for Mineral Projects”.

About Honey Badger Silver Inc.

Honey Badger Silver is a unique silver company. The company is led by a highly experienced leadership team with a track record of value-creation, backed by a skilled technical team. Our projects are located in areas with a long history of mining, including the Sunrise Lake project with a historic resource of 12.8 Moz of silver at a grade of 262 g/t silver (and 201.3 million pounds of zinc at a grade of 6% zinc) Indicated and 13.9 Moz of silver at a grade of 169 g/t silver (and 247.8 million pounds of zinc at a grade of 4.4% zinc) Inferred(2) located in the Northwest Territories and the Plata high grade silver project located 165 km east of Yukon’s prolific Keno Hill and adjacent to Snowline Gold’s Rogue discovery. The Company’s Clear Lake Project in the Yukon Territory has an unclassified historic resource of 5.5 Moz of silver at a grade of 22 g/t silver and 1.3 billion pounds of zinc at a grade of 7.6% zinc(3). The Company also has a significant land holding at the Nanisivik Mine Area located in Nunavut, Canada that produced over 20 Moz of silver between 1976 and 2002(4). We own 10,000 ozs of silver yielding 12% per annum. In each instance, the reliability of the historical resource estimates (the “Historical Estimates“) are considered reasonable, but a qualified person has not done sufficient work to classify the foregoing Historical Estimates as current mineral resources, and the Company is not treating the estimates as current mineral resources. There is no technical report associated with the Historical Estimates. The Historical Estimate contains categories that are not consistent with current CIM definitions. The Company considers the Historical Estimates to be relevant for the proper understanding of its mineral properties, however, significant data compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person for the Historical Estimates to be in accordance with NI 43-101 standards and to verify the Historical Estimates as current mineral resources. No more recent estimates of the mineral resources or other data are available to the Company. There can be no certainty, following further evaluation and/or exploration work, that the historical estimates can be upgraded or verified as mineral resources or mineral reserves in accordance with NI 43-101.

- Khorshidi, N. (2025). Antimony in Canada: Challenges and opportunities in critical mineral supply and demand. FACETS, 10, 1–18. https://doi.org/10.1139/facets-2025-0079

- Sunrise Lake historic resource (2000-2003): Indicated 1.522 million tonnes grading 262 grams/tonne silver, 6.0% zinc, 2.4% lead, 0.08% copper, and 0.67 grams/tonne gold and Inferred 2.555 million tonnes grading 169 grams/tonne silver, 4.4% zinc, 1.9% lead, 0.07% copper, and 0.51 grams/tonne gold. The resource estimate for the Sunrise Deposit was carried out by Silver Standard Resources Inc. (SSR) using a classical polygonal method that relied on 72 diamond drillholes and an average density of 4 t/m3. Drill hole intercepts were taken directly from the drill logs (CBA 1998). Polygons were created within AutoCAD and AutoCAD calculated the areas. Horizontal widths were calculated using the ratio of core length to the width used by CBA in their 1998 estimate. Intercepts not used by CBA were measured on the cross sections. The intercepts were composited primarily using a geological cut-off based on the sulphide content and a nominal 30 g/t Ag grade. Internal values below 30 g/t were included for geological continuity if the composite remained above cut-off. Stringer mineralization was included where silver grades were above 30 g/t and occasionally lower if base metal grades were high. It is assumed the upper 100 m could be mined by open pit methods and the stringer mineralization would have to be removed to access the massive sulphides. The classification of the mineralization is based on the number of drill holes on a section and the continuity of the mineralization. The main massive sulphide horizon has been drilled on sections spaced 40 m apart, and above the -280 m elevation, the down dip continuity of the horizon has been tested with holes 25 to 30 m apart down dip. All mineralization in the massive sulphide horizon above 280 m is considered an Indicated Resource while the near surface stringer mineralization and the massive sulphides below 280 m are considered to be Inferred Resources. Forty holes define the massive sulphide Indicated Resource horizon. In a 2003 report to SSR, Roscoe Postle Associates Inc. (RPA) concluded SSR’s resource estimate was reasonable based on approximating a NSR using typical smelter contracts, assuming metallurgical recoveries based on the limited metallurgical testing and on the following price assumptions: USD$ 5.50 per ounce silver, USD$ 400 per ounce gold, USD$ 0.45 per pound zinc, USD$ 0.25 per pound lead, and USD$ 0.80 per pound copper, as well as a USD$ 75 transportation cost, and a CDN$ 1.45:USD$ 1.00 exchange rate.

- Clear Lake historic Resource (2010): Inferred 7.76 million tonnes grading 22 grams/tonne silver, 7.6% zinc, and 1.08% lead. In 2010 SRK was engaged to complete a NI 43-101 compliant resource estimate for the Clear Lake deposit for Copper Ridge Explorations Inc. The estimate was made utilizing 1,842 assays from within the deposit, from a total of 13,168 m of drilling in 63 historical drill holes. An average density of 4.07 gm/cc was used, based on a limited number of field measurements that were confirmed in the laboratory, and with a minimum thickness of 2 m. Mineral resources were estimated by ordinary kriging in 12m by 12m by 9m blocks. The mineral resources are reported at a 4% (Pb+Zn) cut-off. Pb grades have been capped at 1.5% and Ag grades were capped at 60 g/t. Although SRK placed this resource in the inferred category due to uncertainties related to the historical nature of the available data, they noted that most of the resource has been drilled at a sufficiently close enough spacing to support indicated classification. The above information has been taken from a news release by Copper Ridge dated January 18th, 2010, as no technical report is publicly available.

- Geological Survey of Canada, 2002-C22, “Structural and Stratigraphic Controls on Zn-Pb-Ag Mineralization at the Nanisivik Mississippi Valley type Deposit, Northern Baffin Island, Nunavut; by Patterson and Powis.”

ON BEHALF OF THE BOARD

Chad Williams, Executive Chairman

Sonya Pekar

Investor Relations

[email protected] | +1 (647) 498-8244

For more information, please visit our website www.honeybadgersilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release, including without limitation, the potential of the Nanisivik project. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Honey Badger to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Such factors include, but are not limited to, risks relating to capital and operating costs varying significantly from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR+ (www.sedarplus.ca) under Honey Badger’s issuer profile. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed timeframes or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.