Toronto, Ontario, January 21, 2026 – Honey Badger Silver Inc. (TSXV: TUF | OTCQB: HBEIF) (“Honey Badger” or the “Company”) is pleased to share that the company has newly recognized important critical minerals potential at its 100%-owned Plata project in the Yukon, including widespread high-grade antimony as well as copper and tungsten mineralization.

The Company’s Executive Chairman, Chad Williams, commented, “During the ongoing data review following the company’s recent fieldwork at Plata, we have recognized extensive high-grade antimony, copper, and tungsten mineralization within and around the Ajo Zone. The presence of these critical minerals, historically untested, compliments the known silver, gold, lead, and zinc mineralization, and underscores the outstanding mineral endowment at Plata, which continues to positively surprise us. I have said many times, and continue to believe, that because of its multiple types and locations of mineralization spread over vast distances, Plata is the property with the best exploration potential that I have seen in my 40-year career. We are excited to advance the Plata project this year as we prepare for Plata’s first drill program in nearly 15 years.”

Newly Recognized Critical Minerals at Plata

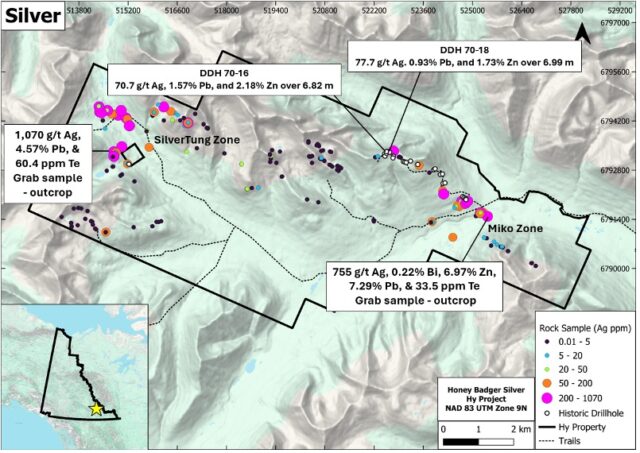

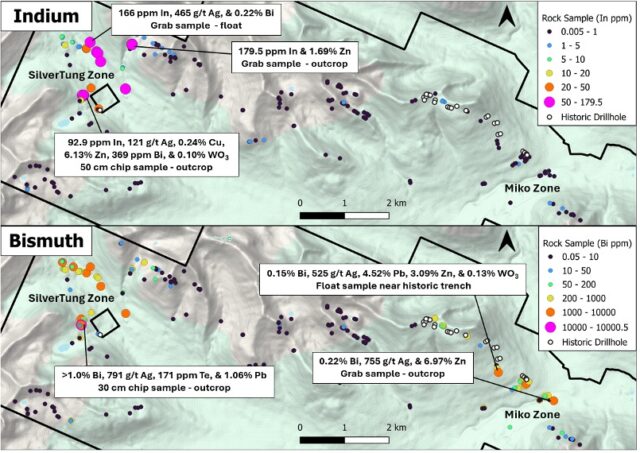

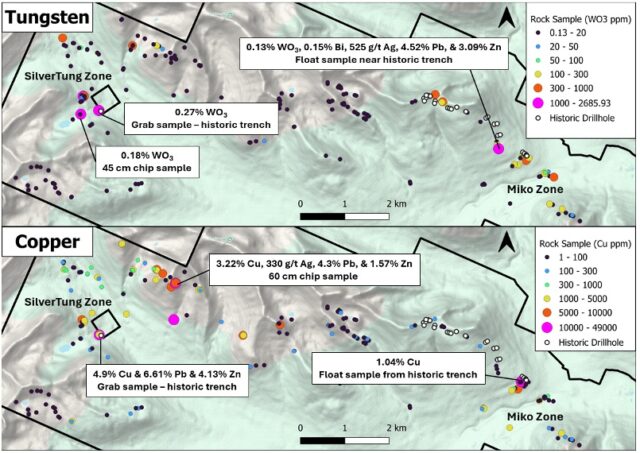

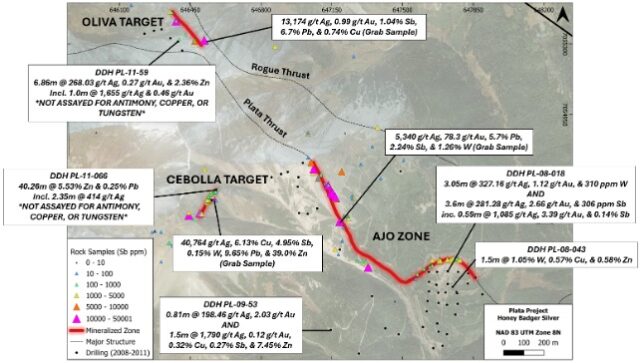

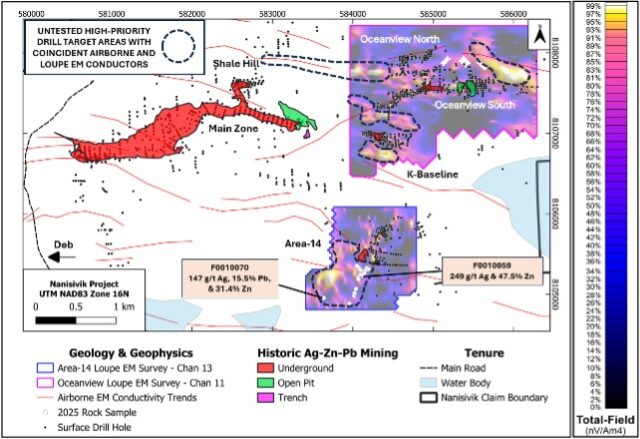

To date, the majority of known silver, gold, and base metal mineralization at Plata has been largely concentrated at the Ajo Zone, which represents a fairly consistent ~northwest-southeast trending tabular body (~1-6m wide) of high-grade silver-, gold-, lead-, and zinc-bearing quartz veining that is structurally hosted along the Plata Thrust Fault for approximately 1 km of currently known strike length. Other important silver mineralization near Ajo includes the Cebolla and Oliva Targets, historically referred to as the P2 and P6 targets, to the west and northwest, respectively. These target areas are understood to be controlled by late ~north-south trending structures and comprise wide (~5-20m) zones of massive sulfide mineralization containing high-grade silver, zinc, lead, and low-grade gold mineralization (Fig. 1). Although the focus at Plata will remain centered on expanding the silver and gold potential, recognizing the presence and added economic potential of antimony, copper, and tungsten is important given the increased demand for building domestic supply chains of these important critical minerals. This is the first time that Honey Badger Silver has documented the presence of high-grade antimony, tungsten, and copper mineralization at Plata, which were historically ignored by prior operators.

Figure 1. Map of the Plata Project showing antimony-in-rock values on surface across the Ajo Zone, Cebolla Target, and Oliva Target. Select grab samples and drill results are highlighted in text that show high-grade antimony, copper, and tungsten values in addition to high-grade silver, gold, lead, and zinc mineralization.

*Rock samples consist of material that has been classified as outcrop, subcrop, chip, and channel samples, as well as samples that are “undefined”. Samples classified as float have been excluded from the map.

*Drill intercepts from the Ajo Zone and Oliva Target are interpreted to represent close to true width, whereas drill holes from the Cebolla Target are understood to have intersected the mineralized lens at a steeper angle and a true width is potentially ~65% less than the apparent width.

Critical Minerals Potential

Antimony (Sb)

Antimony mineralization is widespread at Plata and is present in the Ajo Zone, as well as both the Cebolla and Oliva targets. High-grade antimony importantly occurs throughout the entire length of the Ajo Zone, where 62 out of 144 rock samples collected along or adjacent to the structure returned over 0.1% Sb, 17 samples returned over 1.0% Sb, and five samples returned above the overlimit detection value of 5.0% Sb (Fig.1). Antimony mineralization at Ajo is also positively reflected in historical drill results and shows a strong positive correlation to silver. Antimony highlights from select drill results at Ajo include 1.5m @ 1,790 g/t Ag, 0.12 g/t Au, 0.32% Cu, 0.27% Sb, and 7.45% Zn (PL-09-53), 1.21m @ 1,255.36 g/t Ag, 1.11 g/t Au, & 0.14% Sb (PL-08-016), and 0.59m @ 1,085 g/t Ag, 3.39 g/t Au, & 0.14% Sb (PL-08-018). High-grade antimony is also present at both the Cebolla and Oliva targets with rock sample grades up to 4.95% Sb at Cebolla and 4.72% Sb at Oliva. Drill core from the Cebolla and Oliva targets was not assayed for antimony along with select drill core from Ajo, however the widespread presence of antimony with silver mineralization on surface in these areas indicates it may also be present at depth.

Copper (Cu)

Copper mineralization is broadly distributed throughout the Ajo Zone, as well as the Cebolla and Oliva targets. Collectively between these three areas, 77 out of 288 rock samples returned over 0.1% Cu, and 12 samples returned over 0.5% Cu. The highest reported copper grade of 6.13% Cu is from a rock sample collected at the Cebolla target that also returned 40,764 g/t Ag (4.07%), 4.95% Sb, 0.15% W, 9.65% Pb, and 39.0% Zn. Copper highlights from select drill results at Ajo include 1.52m @ 0.57% Cu (PL-08-043), 1.5m @ 0.32% Cu(PL-08-53), and 2.78m @ 0.10% Cu (PL-08-018). Grades over 0.1% Cu are consistently found with high-grade silver and gold mineralization in other drilling from Ajo. Drill core from the Cebolla and Oliva targets was not assayed for copper along with select drill core from Ajo, however the presence of local high-grade occurrences and broad low-grade mineralization on surface suggests that copper mineralization may also be present in the historical drilling at these target areas.

Tungsten (W)

Tungsten mineralization at Plata is variable but importantly present in both rock samples on surface and in historic drill results. The highest tungsten value at Plata is from a rock sample collected in the central Ajo Zone that returned 1.59% WO3 along with 5,340 g/t Ag, 78.3 g/t Au, 5.7% Pb, and 2.24% Sb (Fig. 1). Tungsten mineralization can also be found at Cebolla, where a rock sample returned up to 0.19% WO3. The best-known drill intercept for tungsten is from drillhole PL-08-043 located at the eastern end of the Ajo Zone and returned 1.5m @ 1.32% WO3. Drill core from the Cebolla and Oliva targets along with select drill core from Ajo was not assayed for tungsten. Additional elevated values of tungsten up to 680 ppm WO3 can be found in conjunction with high-grade silver and gold mineralization in other drill holes at Ajo.

Summary of Findings and Next Steps

Although Plata is well known for its high-grade silver, gold, lead, and zinc mineralization, we are extremely pleased to show the added critical minerals value that this project also boasts with the presence of extensive antimony, copper, and tungsten. We are particularly impressed with the scale of high-grade antimony that is prevalent across the Ajo Zone and surrounding targets. This renewed understanding will continue to inform future work at Plata and the design of our anticipated drill program this coming summer, in addition to adding another important layer of economic optionality to the project.

Antimony and Critical Mineral Significance

Antimony is classified as a critical mineral in Canada and has a wide range of applications including the production of flame retardants, batteries, electronics, and renewable energy technologies. China currently controls approximately 80% of global antimony production, resulting in a tightly constrained global supply chain(1). China’s recent export controls on antimony further complicates this situation, leading to price volatility and supply chain disruptions, which impacts global markets including Canada. However, this challenge presents Canada with an opportunity to play a key role in diversifying supply chains and enhancing domestic production of this critical mineral. This opportunity is recognized and exemplified by Canada’s Critical Minerals Strategy, which highlights the need for increased exploration, production, and recycling of antimony, amongst other critical minerals such as copper, tungsten, and zinc. Significant funding is being provided for these initiatives in order to establish Canada as a leading role in the global supply chain.

Qualified Person

Technical information in this news release has been reviewed and approved by Benjamin Kuzmich, P. Geo., a consultant, who is a Qualified Person (QP) for the purpose of National Instrument 43-101 “Standards of Disclosure for Mineral Projects”.

About Honey Badger Silver Inc.

Honey Badger Silver is a unique silver company. The company is led by a highly experienced leadership team with a track record of value-creation, backed by a skilled technical team. Our projects are located in areas with a long history of mining, including the Sunrise Lake project with a historic resource of 12.8 Moz of silver at a grade of 262 g/t silver (and 201.3 million pounds of zinc at a grade of 6% zinc) Indicated and 13.9 Moz of silver at a grade of 169 g/t silver (and 247.8 million pounds of zinc at a grade of 4.4% zinc) Inferred(2) located in the Northwest Territories and the Plata high grade silver project located 165 km east of Yukon’s prolific Keno Hill and adjacent to Snowline Gold’s Rogue discovery. The Company’s Clear Lake Project in the Yukon Territory has an unclassified historic resource of 5.5 Moz of silver at a grade of 22 g/t silver and 1.3 billion pounds of zinc at a grade of 7.6% zinc(3). The Company also has a significant land holding at the Nanisivik Mine Area located in Nunavut, Canada that produced over 20 Moz of silver between 1976 and 2002(4). We own 10,000 ozs of silver yielding 12% per annum. In each instance, the reliability of the historical resource estimates (the “Historical Estimates“) are considered reasonable, but a qualified person has not done sufficient work to classify the foregoing Historical Estimates as current mineral resources, and the Company is not treating the estimates as current mineral resources. There is no technical report associated with the Historical Estimates. The Historical Estimate contains categories that are not consistent with current CIM definitions. The Company considers the Historical Estimates to be relevant for the proper understanding of its mineral properties, however, significant data compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person for the Historical Estimates to be in accordance with NI 43-101 standards and to verify the Historical Estimates as current mineral resources. No more recent estimates of the mineral resources or other data are available to the Company. There can be no certainty, following further evaluation and/or exploration work, that the historical estimates can be upgraded or verified as mineral resources or mineral reserves in accordance with NI 43-101.

- Khorshidi, N. (2025). Antimony in Canada: Challenges and opportunities in critical mineral supply and demand. FACETS, 10, 1–18. https://doi.org/10.1139/facets-2025-0079

- Sunrise Lake historic resource (2000-2003): Indicated 1.522 million tonnes grading 262 grams/tonne silver, 6.0% zinc, 2.4% lead, 0.08% copper, and 0.67 grams/tonne gold and Inferred 2.555 million tonnes grading 169 grams/tonne silver, 4.4% zinc, 1.9% lead, 0.07% copper, and 0.51 grams/tonne gold. The resource estimate for the Sunrise Deposit was carried out by Silver Standard Resources Inc. (SSR) using a classical polygonal method that relied on 72 diamond drillholes and an average density of 4 t/m3. Drill hole intercepts were taken directly from the drill logs (CBA 1998). Polygons were created within AutoCAD and AutoCAD calculated the areas. Horizontal widths were calculated using the ratio of core length to the width used by CBA in their 1998 estimate. Intercepts not used by CBA were measured on the cross sections. The intercepts were composited primarily using a geological cut-off based on the sulphide content and a nominal 30 g/t Ag grade. Internal values below 30 g/t were included for geological continuity if the composite remained above cut-off. Stringer mineralization was included where silver grades were above 30 g/t and occasionally lower if base metal grades were high. It is assumed the upper 100 m could be mined by open pit methods and the stringer mineralization would have to be removed to access the massive sulphides. The classification of the mineralization is based on the number of drill holes on a section and the continuity of the mineralization. The main massive sulphide horizon has been drilled on sections spaced 40 m apart, and above the -280 m elevation, the down dip continuity of the horizon has been tested with holes 25 to 30 m apart down dip. All mineralization in the massive sulphide horizon above 280 m is considered an Indicated Resource while the near surface stringer mineralization and the massive sulphides below 280 m are considered to be Inferred Resources. Forty holes define the massive sulphide Indicated Resource horizon. In a 2003 report to SSR, Roscoe Postle Associates Inc. (RPA) concluded SSR’s resource estimate was reasonable based on approximating a NSR using typical smelter contracts, assuming metallurgical recoveries based on the limited metallurgical testing and on the following price assumptions: USD$ 5.50 per ounce silver, USD$ 400 per ounce gold, USD$ 0.45 per pound zinc, USD$ 0.25 per pound lead, and USD$ 0.80 per pound copper, as well as a USD$ 75 transportation cost, and a CDN$ 1.45:USD$ 1.00 exchange rate.

- Clear Lake historic Resource (2010): Inferred 7.76 million tonnes grading 22 grams/tonne silver, 7.6% zinc, and 1.08% lead. In 2010 SRK was engaged to complete a NI 43-101 compliant resource estimate for the Clear Lake deposit for Copper Ridge Explorations Inc. The estimate was made utilizing 1,842 assays from within the deposit, from a total of 13,168 m of drilling in 63 historical drill holes. An average density of 4.07 gm/cc was used, based on a limited number of field measurements that were confirmed in the laboratory, and with a minimum thickness of 2 m. Mineral resources were estimated by ordinary kriging in 12m by 12m by 9m blocks. The mineral resources are reported at a 4% (Pb+Zn) cut-off. Pb grades have been capped at 1.5% and Ag grades were capped at 60 g/t. Although SRK placed this resource in the inferred category due to uncertainties related to the historical nature of the available data, they noted that most of the resource has been drilled at a sufficiently close enough spacing to support indicated classification. The above information has been taken from a news release by Copper Ridge dated January 18th, 2010, as no technical report is publicly available.

- Geological Survey of Canada, 2002-C22, “Structural and Stratigraphic Controls on Zn-Pb-Ag Mineralization at the Nanisivik Mississippi Valley type Deposit, Northern Baffin Island, Nunavut; by Patterson and Powis.”

ON BEHALF OF THE BOARD

Chad Williams, Executive Chairman

Sonya Pekar

Investor Relations

[email protected] | +1 (647) 498-8244

For more information, please visit our website www.honeybadgersilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release, including without limitation, the potential of the Nanisivik project. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Honey Badger to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Such factors include, but are not limited to, risks relating to capital and operating costs varying significantly from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR+ (www.sedarplus.ca) under Honey Badger’s issuer profile. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed timeframes or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.